Slowing residential sales, rising sea levels and shaky foreign economies feature prominently in a new survey of top Miami real-estate professionals. The results reflect a shift in a previously red-hot international market that dismissed talk of climate change.

For the second year, Miami-based polling firm Bendixen & Amandi International partnered with the Miami Herald to interview 100 of the county’s top real-estate professionals. Participants ranged from developers and brokers to analysts and investors, with 60 percent of respondents overlapping with the previous year’s.

Participants were assured their answers would not be associated with their names.

On some questions, there was little change from 2015. But a few revealed a decided departure in habits, values and opinions.

The takeaway: Although the luxury market has definitely softened, none of these pros expect a hard landing.

As for when the next uptick begins, that answer came not from our survey, but from a preview meeting with respondents. The consensus: The next wave could be just 18 months away.

Below are highlights of year-to-year shifts. You can read the full results of the survey here.

FOREIGN INFLUENCE

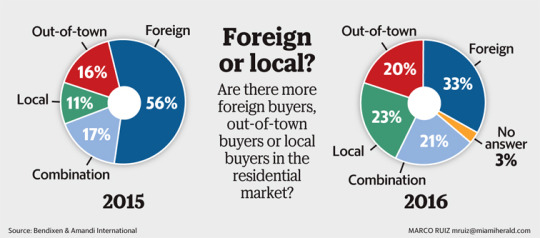

In 2015, more than half of survey participants said foreign buyers dominated the high-end market. This year, only 33 percent — fewer than one-third — said the same, with others favoring local buyers and out-of-towners, primarily from New York.

“The responses fit pretty much with what the economic environment and the markets overseas are telling us,” said Tony Villamil, founder of the Coral Gables-based Washington Economics Groups. “Basically, South America is in recession, and the exchange rate has depreciated between 25 and 40 percent in most countries — major countries such as Brazil, Venezuela, Colombia and Argentina — because of low commodity prices and political problems.”

Those polled agreed nearly across the board that political and financial instability abroad have impacted Miami real estate, with only 8 percent of participants swinging the other way.

WE ARE IN THE GLOBAL ARENA RIGHT NOW.

Christopher Zoller,EWM Realty International broker

“The weakened purchasing power of foreign economies has directly affected the residential real-estate market in Dade," said one industry professional.

The effects of economic turmoil abroad manifest most prominently in the local condo market, in which luxury units are frequently sold for millions in all-cash deals with buyers from Latin American and European countries. (The proportion of respondents who said they dealt mostly with all-cash buyers has diminished, from 68 percent in 2015 to 58 percent in 2016.)

The exodus of foreign cash and return of domestic buyers reverberated elsewhere in the survey. In the category of neighborhood amenities worthy of premium payment, a larger number of respondents signaled interest in quality schools (34 percent, up from 29 percent in 2015) and shrinking emphasis on shopping and dining (11 percent, down from 21 percent). Experts attributed the shift to an adjustment in buyer demographics.

“Many of the international buyers wouldn’t have been concerned with schools. When you look at local buyers, there will be more focus on schools, naturally,” said Bendixen’s Anthony Williams, who also is a Realtor.

But make no mistake — foreign buyers are still very much around.

“Not in numbers like they were, say, a year ago, a year and a half ago, but foreign buyers are absolutely here,” said Nelson Gonzalez, senior vice president of EWM Realty International, who participated in the survey and also agreed to be interviewed on the record.

THE ENTIRE WORLD WANTS A SLICE OF MIAMI.

Nelson Gonzalez, senior vice president, EWM Realty International

South Florida remains a haven for flight capital, and its real estate is a “safe financial investment,” one survey participant said. Demand lingers, too, because of Miami’s international appeal.

“People wanna be here, whether they’re coming from London, Paris or Singapore,” said Christopher Zoller, incoming chair of the Miami Association of Realtors, the nation’s largest.

The uptick in domestic demand for luxury real estate is noticeable, said real-estate analyst Jonathan Miller of MillerSamuels, a real-estate appraisal and consulting group that covers markets across the U.S. Florida boasts tax advantages including homestead exemptions and the absence of state income tax. Its fun-in-the sun lifestyle is also a draw.

“We have the beaches, the lifestyle, shopping, events, arts, culture and proximity to the islands, as well as South America. We have direct flights to nearly every major city in the world,” said Realtor Jill Hertzberg, who makes up one half of a team called The Jills, along with fellow Coldwell Banker agent Jill Eber.

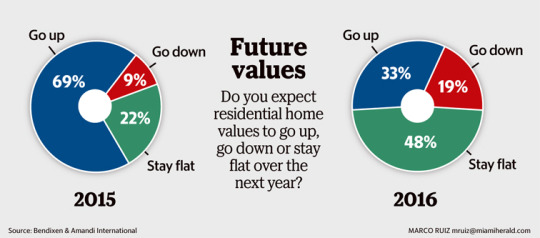

Domestic demand, palpable as it may be, has not soaked up supply. Inventory of luxury condos shot to a 38-month level in March. (The threshold that indicates stability lies between 15 and 18 months.) Survey results mirrored that gap in demand, as 48 percent of respondents projected flattening home values over the next 12 months.

However, said Zoller, the diminishing presence of foreign buyers is only one piece of the puzzle. Great Britain’s potential exit from the Eurozone, global crude oil prices, talks of interest-rate hikes by the U.S. Federal Reserve and the outcome of the presidential election have combined and “sidelined people into a year of uncertainty,” he said.

“Buyers are saying, ‘I’d like to assess the situation and see where I stand before I make a big move and buy my new house in Miami, at any [price] level.’ ”

CLIMATE CONCERNS

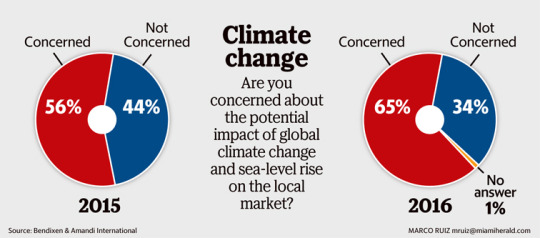

Climate change contributes an additional layer of uncertainty.

Its presence loomed larger this year, as 65 percent of survey respondents reported being concerned about the potential impact of climate change and rising sea levels on the real-estate market. According to the survey, buyers did not share the sentiment; only 22 percent mentioned it as an issue.

“Even if the public isn’t all there yet, at least the real-estate professionals are really taking note of that issue,” Williams said. “It’s a political year, so that has brought the issue to the forefront.”

THE RISKS [OF CLIMATE CHANGE] ARE SPREAD THROUGHOUT THE COUNTY.

Rachel Silverstein, CEO of Miami Waterkeepers

From Hertzberg: “Most consumers are comforted by the fact that there is a great deal of awareness of the situation and therefore a great deal of resources are being put into place to find solutions,” she wrote in an email. “Right here in Miami Beach, buyers see evidence of all the projects that are in progress to address potential flooding and other sea-level-rise issues.”

Engineers completed in late 2015 a radical project that elevated the streets of the Sunset Harbour area by 2 1/2 feet. As much as $500 million will be spent to install 80 pumps and raise roads and seawalls across Miami Beach, ground zero for rising tides and flooding.

But sea-level rise isn’t exclusive to Miami Beach, say experts.

Miami’s topography is low-lying with a shallow water table. Below ground lies porous limestone through which water can pass, “kind of like a sponge,” said Rachel Silverstein, CEO of nonprofit organization Miami Waterkeepers.

“I can’t gauge like, ‘Oh, this many years until Miami is underwater’ or whatever, but [the Southeast Florida Regional Compact] has considered projections of sea-level rise.”

Data cited by the group, a county-level coalition made up by the governments of Miami-Dade, Broward, Palm Beach and Monroe County, projects increases of 6 to 10 inches by 2030 and 14 to 26 inches by 2060. Two more feet of water would lap at storefronts, car undercarriages and bring water over sea walls.

WHEN TO BUY

“What-ifs” notwithstanding, some Realtors say, “Buy now.”

TODAY’S MARKET PRICE IS TOMORROW’S BARGAIN.

Suzanne Hollander, FIU Hollo School of Real Estate

Lending standards are favorable, making home ownership more accessible than in years part, and interest rates, while currently low, are expected to go up before year’s end, said Suzanne Hollander, broker, attorney and professor at FIU’s Hollo School of Real Estate.

“Today’s market price is tomorrow’s bargain,” she said. “You’re missing opportunities if you don’t buy.”

Prices of condos in the luxury market steadily decreased, in tandem with sales, from September 2015 until March — a favorable turn for buyers, Hertzberg points out.

“Investors and second-home buyers may feel that the time is good for buying a property,” she said.

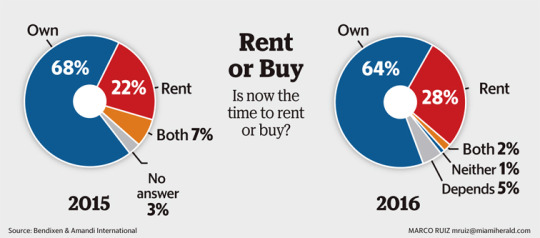

However, slightly fewer survey participants said it was time to own, versus rent, than in 2015. The number of respondents who pointed to “buy” slid while “rent” rose.

Median home prices across the market continue to outpace wage growth — a 9 percent jump year over year, while wages have grown by a mere 4 percent. Meanwhile, developers are turning to rentals, delivering as many as 2,000 units by year’s end; about 12,000 more are in the pipeline. It’s an unprecedented bundle of product, say experts.

“It’s a good time to rent space,” said Villamil. “This is a good time to buy single-family homes, especially in areas that have not seen significant appreciation, like the western side of the county. But I would not buy condos now. Time to rent.”

Looking ahead, real-estate players point to a few areas ripe for growth. Little Havana, for example, was widely considered the most undervalued neighborhood in Miami.

“Little Havana is great because of its proximity to an urban area, and public transportation is a quick and direct commute,” said one respondent.

Median home prices in Little Havana in 2015 hovered around $200,000. About 8 miles away in Miami Beach, median home prices ranged from $1.5 million to $3.2 million, depending on ZIP code. That works out to $75 per eastbound footstep.

The formerly ethnic enclave’s growing appeal isn’t due simply to its affordable price tag. It can be attributed, too, to the trend toward mass transit over individual commutes and proximity to sprawl, say experts.

“We can’t grow out to the ocean or the Everglades, so we’re going to grow in and we’re going to grow up,” Zoller said.

HOW WE DID IT

The Miami Herald wanted to find out what top industry players really think about where Miami’s real-estate market is going.

To that end, the Herald partnered with locally based polling firm Bendixen & Amandi International to conduct an anonymous survey of 100 major developers, brokers and other industry watchers. The arrangement created an opportunity for South Florida’s most knowledgeable sources to speak freely, without the usual pressure of pitching buyers and making sales.

The survey was conducted as a wide-ranging, one-on-one conversation between source and pollster that allowed for open-ended answers, said Anthony Williams, who led the effort for Bendixen & Amandi.

The Herald and Bendixen & Amandi together devised a list of top industry players. Herald writers and editors were given only aggregate results; quotes were not identified by individual to ensure honest responses.

BEST OF THE BEST

As part of the Bendixen & Amandi/Miami Herald real-estate poll, we asked top industry watchers to name the professionals they would choose to buy or sell their homes if they could not use their own companies. They also were asked to name the single most knowledgeable person in the business. The results mirrored those of 2015:

Best brokerage

EWM Realty International

Best Realtor

Jill Hertzberg of Coldwell Banker

Most knowledgeable

Jorge Pérez of the Related Group

Know more about the real estate advisor - Keith Knutsson:

No comments:

Post a Comment